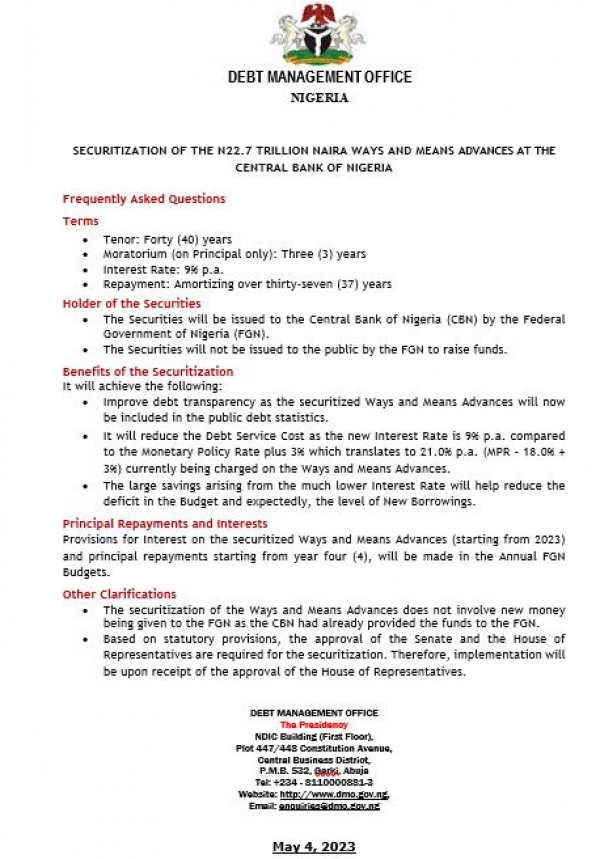

Frequently Asked Questions

Terms

- Tenor: Forty (40) years

- Moratorium (on Principal only): Three (3) years

- Interest Rate: 9% p.a.

- Repayment: Amortizing over thirty-seven (37) years

Holder of the Securities

- The Securities will be issued to the Central Bank of Nigeria (CBN) by the Federal Government of Nigeria (FGN).

- The Securities will not be issued to the public by the FGN to raise funds.

Benefits of the Securitization

It will achieve the following:

- Improve debt transparency as the securitized Ways and Means Advances will now be included in the public debt statistics.

- It will reduce the Debt Service Cost as the new Interest Rate is 9% p.a. compared to the Monetary Policy Rate plus 3% which translates to 21.0% p.a. (MPR – 18.0% + 3%) currently being charged on the Ways and Means Advances.

- The large savings arising from the much lower Interest Rate will help reduce the deficit in the Budget and expectedly, the level of New Borrowings.

Principal Repayments and Interests

Provisions for Interest on the securitized Ways and Means Advances (starting from 2023) and principal repayments starting from year four (4), will be made in the Annual FGN Budgets.

Other Clarifications

- The securitization of the Ways and Means Advances does not involve new money being given to the FGN as the CBN had already provided the funds to the FGN.

- Based on statutory provisions, the approval of the Senate and the House of Representatives are required for the securitization. Therefore, implementation will be upon receipt of the approval of the House of Representatives.

DEBT MANAGEMENT OFFICE

The Presidency

NDIC Building (First Floor),

Plot 447/448 Constitution Avenue,

Central Business District,

P.M.B. 532, Garki, Abuja

Tel: +234 - 8110000881-3

Website: http://www.dmo.gov.ng,

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

May 4, 2023