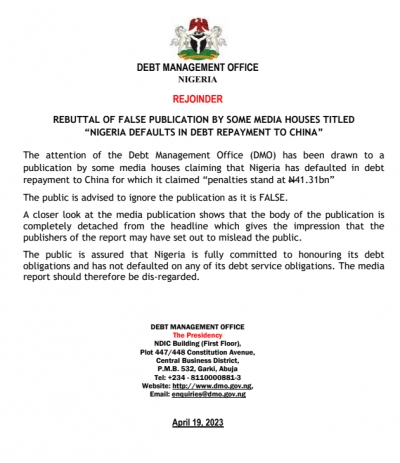

Rebuttal of False Publication by Some Media Houses Titled "Nigeria Defaults in Debt Repayment to China"

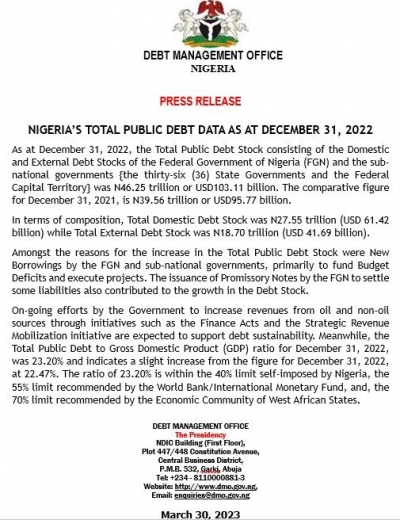

Wednesday, 19 April 2023 11:44Nigeria's Total Public Debt Data as at December 31, 2022

Thursday, 30 March 2023 10:35Demo Presentation and Engagement with Distribution Agents and Market Stakeholders on the FGN Securities Subscription Portal on February 21, 2023.

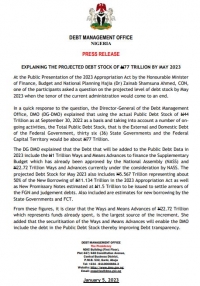

Thursday, 23 February 2023 12:59Press Release: Explaining The Projected Debt Stock of N77 Trillion By May 2023

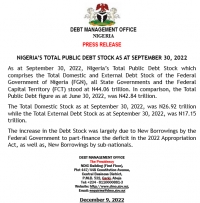

Monday, 09 January 2023 11:08Press Release: Nigeria's Total Public Debt Stock as at September 30, 2022

Friday, 09 December 2022 10:13

Press Release: N100 Billion Sovereign Sukuk Issuance For 2022 Closes on a High Note

Monday, 05 December 2022 07:28

The Debt Management Office (DMO) is pleased to inform the public of the successful conclusion of the Issuance of N100 Billion Sovereign Al ’Ijarah Sukuk. The Offer for N100 Billion opened on November 21, 2022 and was supported by wide public sensitization to encourage subscription from diverse investors, particularly the retail investors. The initial Offer size of N100 billion was upsized to N130 billion due to the over 165% Subscription level. The Sukuk was issued at a Rental Rate of 15.64% per annum. This brings the total Sovereign Sukuk Issuance to N742.557 billion as at date.

The level of subscription is evidence of investors’ confidence in the use and impact of Sukuk in the construction and rehabilitation of road infrastructure across the country. The proceeds of the 2022 Sovereign Sukuk, like the previous Sukuk Issue Proceeds, will be used solely for the construction and rehabilitation of key road projects through the Federal Ministry of Works and Housing and the Federal Capital Territory Administration.

The DMO appreciates all the investors (Retail Investors, Banks, Pension Fund Administrators, Assets/Fund Managers, Insurances Companies, Ethical Funds, Takaful Operators/Non-Interest Banks, Stockbrokers, Government Agencies, High Net Worth Individuals, Trustees and Unit Trusts) who have continued to support the Federal Government’s infrastructure development efforts through Sukuk financing. The strong participation of retail investor, ethical funds and non-interest financial institutions in this Sukuk Offering, attest to the fact that the Government’s objective of promoting financial inclusion through admitting more retail investors and ethical funds into the financial system is being achieved.

The DMO on its part, will work to sustain the laudable achievements recorded so far in the use of Sukuk Issue Proceeds for the construction and rehabilitation of Nigerian roads, and thereby, continue to enhance ease of commuting and doing business, safety on our roads, job creation, economic growth, and prosperity of our nation.

DEBT MANAGEMENT OFFICE

The Presidency

NDIC Building (First Floor),

Plot 447/448 Constitution Avenue,

Central Business District,

P.M.B. 532, Garki, Abuja

Tel: +234 - 8110000881-3

Website: http://www.dmo.gov.ng,

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

December 05, 2022

Press Release: Nigeria's Total Public Debt Stock As At June 30, 2022

Monday, 19 September 2022 16:43PRESS RELEASE

NIGERIA'S TOTAL PUBLIC DEBT STOCK AS AT JUNE 30, 2022

The Total Public Debt Stock, representing the Domestic and External Debt Stocks of the Federal Government of Nigeria (FGN), the thirty-six (36) State Governments and the Federal Capital Territory (FCT), was N42.84 trillion (USD103.31 billion) as at June 30, 2022. The comparative figures for March 30, 2022, was N41.60 trillion (USD100.07 billion).

The Total External Debt Stock was USD40.06 billion (N16.61 trillion) as at June 30, 2022, which was about the same level as the figure for March 31, 2022, which stood at USD39.96 billion (N16.61 trillion). Over fifty-eight percent (58%) of the External Debt Stock are concessional and semi-concessional loans from multilateral lenders such as the World Bank, International Monetary Fund, Afrexim and African Development Bank and bilateral lenders including Germany, China, Japan, India and France.

The Total Domestic Debt Stock as at June 30, 2022, was N26.23 trillion (USD63.24 billion) due to New Borrowings by the FGN to part-finance the deficit in the 2022 Appropriation (Repeal and Enactment) Act, as well as New Borrowings by State Governments and the FCT.

The Total Public Debt to GDP as at June 30, 2022, was 23.06% compared to the ratio of 23.27% as at March 30, 2022, and remains within Nigeria’s self-imposed limit of 40%. While the FGN continues to implement revenue-generating initiatives in the non-oil sector and block leakages in the oil sector, Debt Service-to-Revenue Ratio remains high.

DEBT MANAGEMENT OFFICE

The Presidency

NDIC Building (First Floor),

Plot 447/448 Constitution Avenue,

Central Business District,

P.M.B. 532, Garki, Abuja

Tel: +234 - 8110000881-3

Website: http://www.dmo.gov.ng,

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

September 19, 2022

Official Retreat on the Review of the DMO (Establishment, Etc.) Act, 2003 in Abuja on September 6, 2022

Wednesday, 07 September 2022 23:11Yesterday, the DMO held a retreat for the review of the Debt Management Office (Establishment, Etc.) Act, 2003 at the NAF Conference Centre, Kado, Abuja.

The one-day retreat, which was facilitated by Adeyinka Ajayi and Co. legal practitioners, gave senior staff and management of the DMO the opportunity to evaluate the Act and make possible recommendations where necessary.

The retreat was facilitated by Adeyinka Ajayi and Co. legal practitioners.